John Stewart is Director of Economic Affairs at the Home Builders Federation (HBF).

His policy responsibilities include the economy, the housing and mortgage markets, mortgage regulation, NewBuy, demographic trends, housing supply, Affordable Housing, new home valuation, the private rented sector, customer satisfaction and the industry's Consumer Code, the Cumulative Impact of Regulation on viability and supply and Homes and Communities Agency (HCA) initiatives (FirstBuy, Get Britain Building, public land disposal). He maintains close contact with a wide range of housing experts, including officials at the Department for Communities and Local Government (CLG), the HCA, HM Treasury and the Bank of England.

Before joining HBF in 2003 he was an independent housing consultant for over ten years, and previously divisional Sales & Marketing Director for house builder Wates. His publications included a monthly Viewpoint column in Housebuilder and Building a Crisis (2002) which highlighted the growing housing supply crisis in England and began to consider its social and economic consequences.

He has an MA in English from Auckland University and an MSc in Economics from Birkbeck College, London.

Making planning work

To achieve the required step-change in housebuilding, local authorities must accept responsibility for meeting the housing needs of their whole community and there must be a much more realistic view of the role and limits of planning, says JohnStewart

Industry capacity key to solving supply crisis

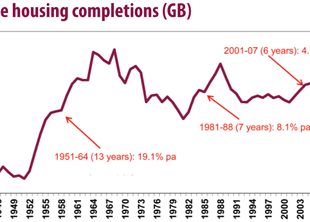

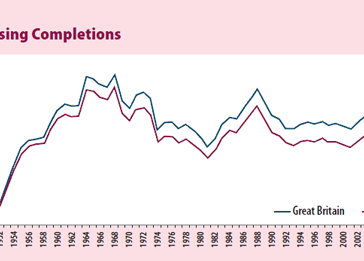

To have any hope of solving our housing supply crisis we need to restore pre-1991 supply conditions so that housebuilders can respond to market demand and industry capacity can expand

No room for local standards

There is no justification for local authorities setting building performance standards. The government’s Housing Standards Review must conclude that standards should be set in Building Regulations only, argues John Stewart

Help to Buy risks and rewards

The Help to Buy Equity Loan scheme will boost home building, but we cannot ignore the risks the mortgage guarantee scheme poses to housing market stability in 2015 and 2016

Rental proposals highlight supply crisis

Special measures to attract institutional investment into the private rented sector will bring short term benefits to home builders but they do not address the fundamental reasons why institutionally funded development is not viable, says John Stewart.

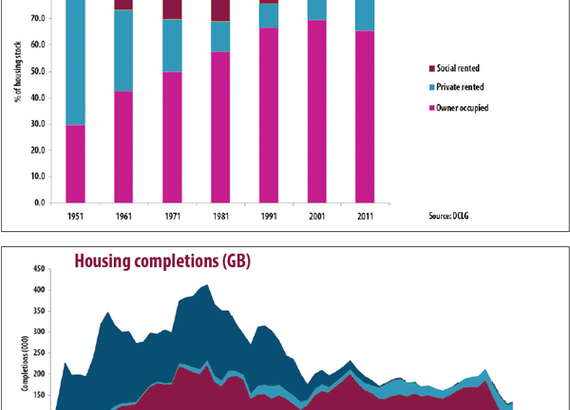

Thatcher's housing legacy

The effects of Margaret Thatcher's policies to revive the private rented sector and withdraw the state from direct housing provision are still with us, but her desire to see a property owning democracy has been undermined, says John Stewart.

Budgeting for the general election

The two Help to Buy Budget housing measures must have been influenced by electoral calculation, but John Stewart does not accept the almost wholly negative reaction of the media and housing commentators.

City re-rating despite weak housing market

A sustained recovery in the housing market remains elusive and home building has fallen sharply, but City optimism has dramatically pushed up housebuilders' share prices according to John Stewart.

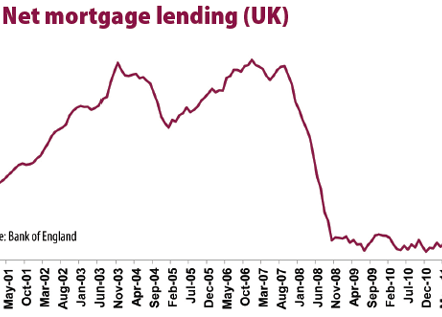

Predictions of boom and bust

John Stewart examines conflicting claims that house prices are destined to fall another 20% alongside recent suggestions that another house price boom is inevitable once demand recovers.

More planning means less housing

Taking part recently in a blue skies discussion about the planning system, John Stewart was forced to ask some fundamental questions. Why do we have a planning system? Why do we have the one we have? Could we have a better one?